Last week I went to Riga to participate in the annual convention of the European Rental Association. With the theme ‘Rental in Transition’ the convention rightfully worded the pivotal junction in time. Fuelled by the European Green Deal we are poised to rebuild our economy towards net zero emmisions. This means construction will boom requiring lots of construction equipment. The big challenge for OEM, dealer, rental and construction companies will be to manage the installed base of construction equipment from a carbon footprint and emmisions perspective.

Collective bargaining

When the representative of the EU, the consultant from the Boston Consulting Group and the chairman of the European Construction Industry Federation talked about the need and drivers for transition, I had this nagging question. Suppose I own a construction equipment fleet of 1b$, the majority still being internal combustion engine (ICE) based, how do I monetise that investment if the awarding of new construction jobs is based on lower carbon footprint and emission levels?

This is big. This is a challenge of major proportions. Though the delegates subscribed to the mid-term sustainability and transformation goals, for the short-term there’s that ominous questionmark of the how-to. The impact and magnititude of the sustainability transition shows how OEM, dealer, rental, construction companies and legislators are intertwined. This requires a serious dose of collective bargaining.

Preparing for the transition

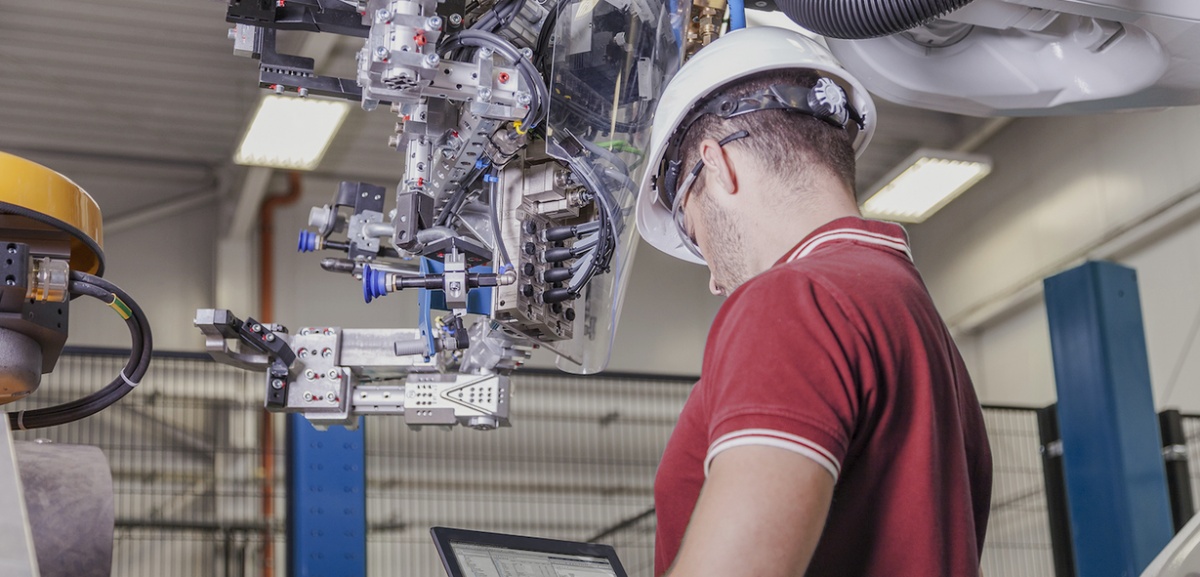

Regardless of how the transition is going to pan out, for all players in the value chain it is imperative to prepare for the transition. It will become increasingly important to understand the usage profile of construction equipment versus generic equipment attributes.

Let me explain with an example in the car rental industry. When you rent a car it typically comes with a mileage allotment per day. If you drive more, you pay more. If you drive less you still pay the daily rate. You could also split the rental model in an ‘availability’ and ‘usage’ component. Especially if the usage component drives carbon and emissions output, splitting the rental model can motivate the user for a more sustainable use.

This simple example sits at the core of asset-centric business models. It’s not about owning of having an asset, it’s about using it. See here the incentive to digitally transform your business and get access to equipment usage information. Bye the way, if you are catering to the larger construction companies, you will know that providing the usage data of construction equipment is a critical element of the rental service.

Carbon offsetting

Most of the delegates flew to Riga. Upon buying their airline ticket each had a possibility to purchase the carbon-offsetting option. How many did buy that option? Today the majority of the rental companies offer a similar carbon-offsetting option for rental equipment. How often is that option selected? A brief survey amonst the delegates revealed the non-scientific value of ±5%. Rental today is a very price sensitive industry.

When I look at the construction deadlock in my own country, the Netherlands, I see that each new project must submit a carbon and emissions overview before even getting a building permit. We heard the EU representative make remarks along similar lines. “We will use carrot and stick”. And we know of sustainability-forefront-cities only awarding projects to eco-frontrunners.

Does this mean that we can only use electric or hydrogen based equipment for future construction projects? Contemplating on the sheer size of the sustainability challenge, the answer will be ‘no’. There simply isn’t enough construction equipment to get all the work done. But if you want to continue using ICE equipment, you need to get smart at carbon-offsetting options. At the conference we heard that a CO2 calculator is a good start, but we need to make it easier to use and equipment usage based.

Beyond Equipment

For the mid and longer term we have an adject challenge when replacing ICE equipment with electric and hydrogen based alternatives. For ICE equipment we can build on the existing infrastructure of fosile fuels. And for remote locations we can very easy offer a fuel management option.

If we want to deploy electric and hydrogen based equipment, it often means we have to supply the complete EV or hydrogen powertrain as well. This implies that the rental paradigm will change from equipment rental to complete solutions rental. From an asset management and equipment availability perspective that will mean that the complexity will increase. This will feed the argument for accelerated digital transformation.

In completely different acumen we could label this as ‘servitisation’. When the contractor needs to excavate 100 tonnes of rock, he’ll need an excavator, dumpster truck and complete power train. As food for thought for rental, would it be too far off to start selling electricity/ hydrogen as well?

Beyond Riga

It was great to be in Riga. To hear so many people in the industry. The challenge is big. Yes, there are some threats. Yes, there is a level of denial and green-washing too. On the other hand, the challenge provides a great number of opportunities too. Those who embrace those challenges and embark on their digital transformation journey, those will have the upper hand in a rental market that is in transition.

This article is published on Field Service Digital.

Previous blog on rental.