During last week’s High Tech Manufacturing event in the Netherlands, we reimagined tomorrow’s service delivery in the context of vocal and demanding customers. If customers expect products to work, is it enough to mitigate downtime, or should you know why your products work and in the context of customer usage? Is your current services portfolio in line with tomorrow’s customer expectations?

Bronze, Silver & Gold Contracts

In reviewing the services portfolio I used words like bronze, silver, and gold contracts to paint a continuum of reactive to proactive and predictive contracts. In an earlier blog on Mind the Gap, I used gold to quantify your maximum services revenue.

Proverbially the gold contract is the ultimate bundle of services to guarantee the uptime of the equipment. It’s not really product-as-a-service, as the customer still needs to buy both the product and a service contract, but outcome-wise it is the next best thing.

Just like with any product or service that is sold today, B2B or B2C, the big question is: who decides what is put into the bundle? Is it a seller-push or a buyer-pull?

This is exactly the challenge the high-tech manufactures are facing today. Based on our discussions during the event, the consensus was: we need to provide more choice and autonomy to our customers. Even if the installed product is the same, the usage context is different case by case.

Product Push vs. Usage Pull

It is not uncommon that the current bronze, silver, and gold bundles are based on product characteristics. When we sell expensive and/or complex products, we tend to believe we need to offer the higher segment of bundles. But if your expensive product is used in lower utilization environments, then the cost of downtime to its owner is lower, resulting in less budget for mitigating strategies. That unit may end up with a bronze contract.

If we want to address the challenge of more vocal and demanding customers, we need to flip the bundling paradigm from product to usage characteristics. To understand those usage characteristics we need to have a mitigating strategy conversation with the owner/user of the product.

Mitigating Strategy Conversation

“Dear buyer, why is my product so important to you, and what happens if my product fails? What impact does downtime have on your operations?”

If your customer is buying your product, meaning there is a point of title passage, it implies that all risks associated with owning the product reside with your customer. As a product owner, your customer will define a mitigating strategy for uptime/downtime risks throughout the life cycle of the product. As OEM you can help the product owner by offering life cycle services. The owner will weigh risk versus price.

“Dear buyer, do you agree with me that throughout the life cycle of the product you will need the following service activities to maintain and safeguard the uptime of the product? Which of those activities do you want to execute yourself and which ones do you want me to do?”

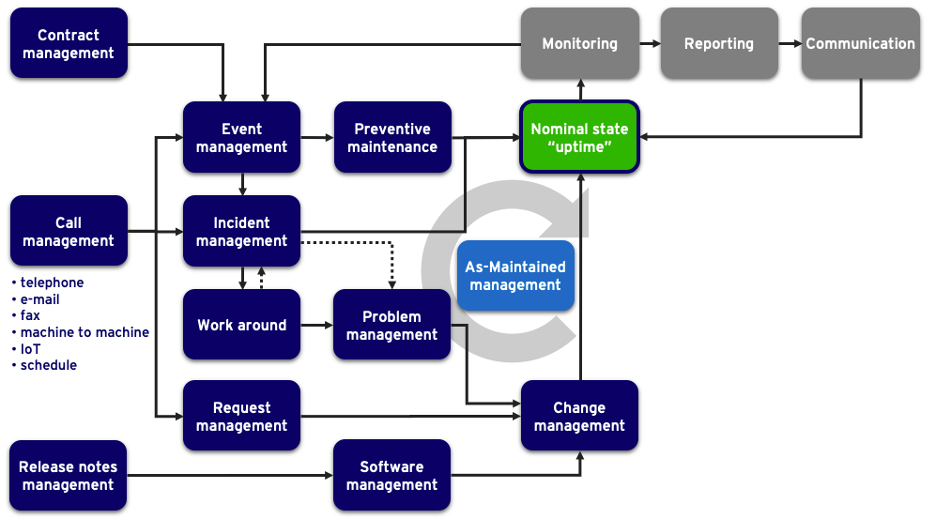

The above picture a derived from the ITIL v4 framework by Axelos. All boxes serve the nominal state of the product, the uptime. And uptime ensures the output and outcome of the product. If your customer agrees with this landscape of services, the conversation becomes a simple one: what level of risk does the owner/buyer want to retain, versus outsourcing that risk to a service provider in exchange for a fee.

Driving Business Results with Entitlement Process

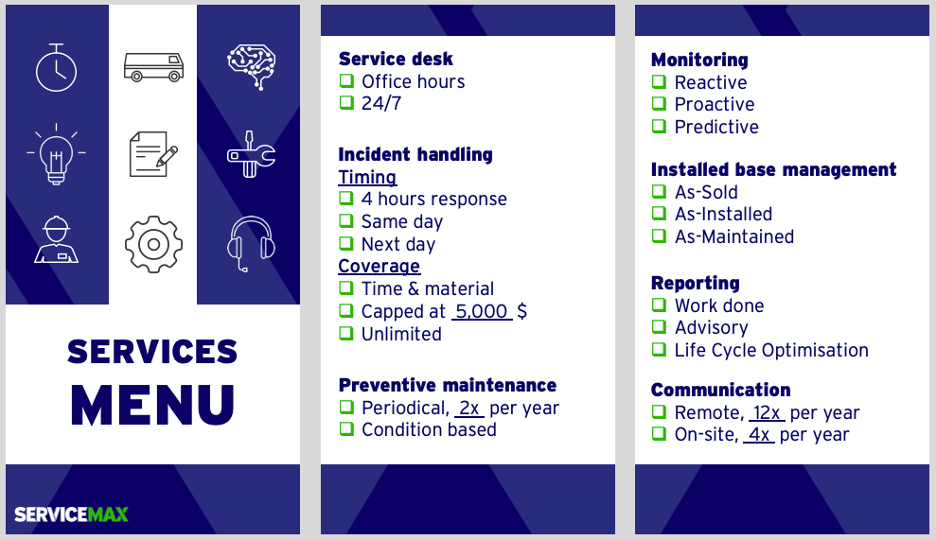

Flipping the service bundle paradigm and handing over the choice to your customer may sound scary. Is it controllable? With modern-day field service management software the answer is yes. It’s similar to going to a restaurant. You define what is on the menu. Your customer has the choice. And any good chef knows that the personal interaction at the table when ordering is key to the choices made. The success of CSAT starts when ordering.

With modern tools, you can implement a service menu card in the service-sales process. The true value comes from pairing the menu card with an entitlement engine in your service delivery process. It’s great that you sold all those configure-to-order service contracts to meet customer requirements. The people that have to deliver the services need to be aware of what has been promised, what has been paid for, and what is billable. This is where the entitlement engine kicks in.

A sophisticated entitlement engine has visibility on the customer, the asset, the contractual obligations agreements, and on the specifics of the customer-ask as specified in the case or work order. As ‘gatekeeper’ the entitlement engine will drive:

- Customer expectation & satisfaction

- Leakage reduction

- Cross & Upsell increase

To accommodate vocal and demanding customers a service menu card is a good alternative to bronze, silver, and gold bundles. Having choice and autonomy creates engagement and builds the foundation to success and CSAT.

To stay in the restaurant analogy, the proof is in eating the pudding. Your service delivery organization needs to have insight into what has been sold/ promised and be able to act on it. Imagine the waiter bringing the food without knowing the order. No tip, invoice at risk, no return visit.

The service menu card and the entitlement engine go hand-in-hand. Say what you do then do what you say.

Learn more about service contracts & entitlements from ServiceMax here.

This article is published in ServiceMax Field Service Digital on October 21st, 2021