Do you have this feeling that the battery of your phone drains faster and faster? Internet forums are full of testimonials and resolutions for keeping your battery in tip-top shape. How does this apply to B2B products, equipment and assets? Can asset owners monitor the performance of the equipment, and what handles do they have to maintain output/ outcome at the nominal level promised at point of sale?

For many years I’ve captured the digital and service transformation journey in a single tagline: “from fixing what breaks to knowing what works.” The message is driven by a simple principle: customers expect things to work. Even more, they expect the outcome of the asset to be stable over the lifecycle.

Another simple truth is that everything eventually deteriorates and breaks. This prompts the following questions:

- What is the life expectancy of the asset?

- What do I need to do to keep the asset in shape?

- What can I do to extend the life cycle of the asset?

Building a Fitness Plan

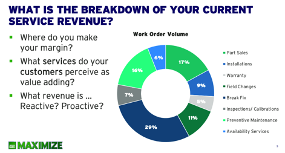

Preventive maintenance might be the first thing that comes to mind as the way to keep your assets in shape. But what does preventive maintenance (PM) prevent? And how does it affect asset performance and life expectancy? This was a tough question to answer when one of my counterparts in procurement, who was looking to reduce the selling price of a service contract, asked me, “What will happen when we reduce the PM effort by lengthening the interval?” This was even more difficult to answer when it became a numbers game, and the purchaser asked me to prove the offset between PM and break-fix.

So where do we look next? I propose condition-based maintenance.

We know that the performance of an asset will deteriorate over time, and we know the rate of deterioration will depend on various attributes like aging and usage. Because these attributes are measurable, we can use them as levels to trigger a service intervention.

So rather than taking a one-size-fits-all approach based on time intervals, you can create a custom fitness plan for keeping your assets in shape. One that looks at the condition of the asset in relation to its expected performance. This can look like an intervention being triggered when the output of an asset or the viscosity of a lubricant drops below a certain threshold.

To continue with the fitness metaphor, we often don’t just want to stay in shape—we also want to increase our longevity and even get in better shape as we age. When it comes to your assets, this is where mid-life upgrades, booster-packs and engineering changes come into play. And in the same way you use predefined levers to trigger service interventions, you should use these levers to trigger updates, upgrades and lifecycle extensions.

Both of these service strategies use asset health at the core of your service delivery model, steering you away from ‘fixing what breaks’ and towards ‘knowing what works.’

A Real Life Example

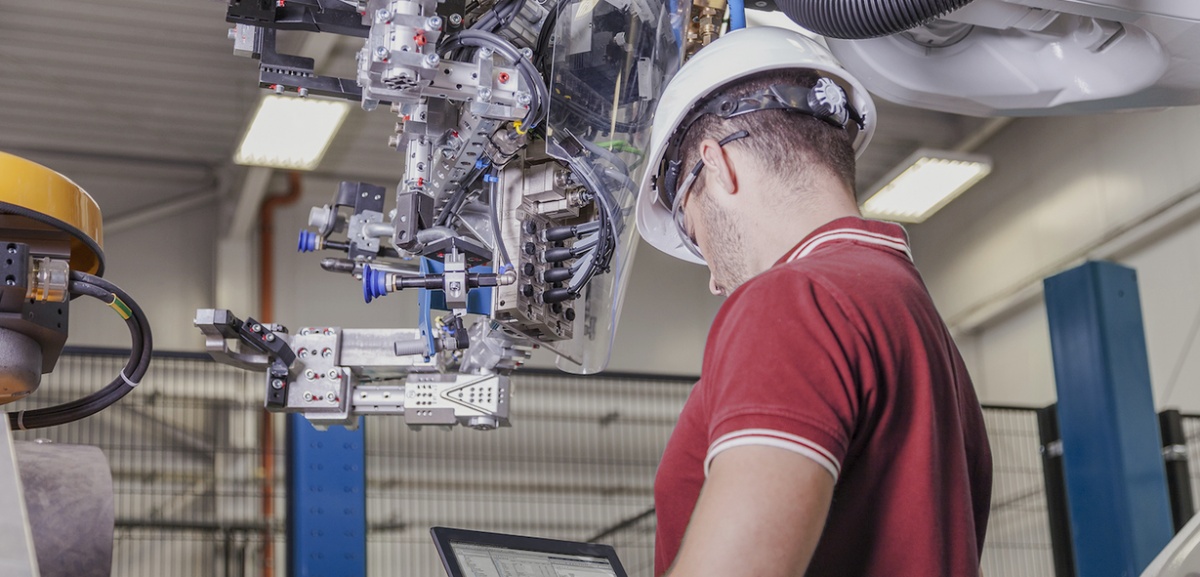

Imagine you have a pump and valve combination that has a nominal capacity of 140 m3/h.

If you used a preventive maintenance model that runs every 6 months, it would not take into account the age of the pump and valve combination, nor would it account for the corrosiveness of the transported materials.

But if you took a condition-based approach using IoT-connected sensors, you could measure attributes like vibration, temperature, and energy consumption and use them as indicators for asset performance. For example, if the capacity drops below 130 m3/h, a service intervention would be triggered. It’s like the pump saying: “I’m not feeling well, I need a medicine.” On top of this, if you detect the pump is consistently pushed beyond original specifications, you can know that it’s necessary to initiate an upgrade conversation to safeguard asset health and durability.

Asset Centricity

The common theme of these service strategies is asset centricity. It’s about putting asset health at the core of your service delivery model and continuously comparing an asset’s current output with its expected performance.

By looking at current performance, expected performance and demand, you can also advise your customers on when it’s time to downgrade or upgrade the asset. Through this asset-centric lens you can truly become a fitness coach, advising your customers on the right fitness program that will keep their assets in tip-top shape.Learn more about IoT and condition-based maintenance here.

This article is published in ServiceMax Field Service Digital on September 1st, 2021 and Field Service News on August 25th, 2021.