As an equipment manufacturer, you hope a product recall never happens. In reality, most OEMs have their share of misfortune. The recent example of Philips apnea machines shows how complex a recall process can be. How it can get out of hand. How it can impact your brand experience. Instead of trying to avoid product recalls it is better to be prepared for them.

Preparing for the unlikely

Every product is designed with a set of checks and balances. In the final stages, before general availability, Quality Control assesses safety and fit-for-purpose. Once the product hits the market in grand(er) volumes, the OEM will receive a much larger dataset telling how the product performs and behaves in real-life situations. That is, if the OEM has set up a channel to listen.

When you’re in the middle of a product recall, all stakeholders will be aligned and feel the sense of urgency of using data to mitigate the quality issue. If you hadn’t setup a data collection process, the ability to reconstruct the data is limited and likely comes at a high cost. You’ll also have to be mindful that a product recall is a period of anxiety to both the OEM executives as well as the owners of the affected products.

In our practise, we see that companies that come prepared experience lower costs and higher customer loyalty. These benefits are incentivising other OEMs to follow suit. Especially when the pace of launching new products is increasing and quality assurance is under duress.

Gaining installed base visibility

In an ideal world, any OEM would love to know where each product sold is installed, in what state it is, and how it is being used. The value of that data will enable the OEM to develop better products, be more efficient in their service delivery, and increase their service revenue through hyper-personalized service offerings.

In the real world, we see a lot of OEMs struggling with their installed base visibility. And this is a real problem. If you don’t see your installed base, how do you expect to be efficient in service delivery and driving revenue from that base? It becomes really problematic when you have a quality issue with a product and you don’t know where they are.

Managing the indirect sales channel

The apnea case shows the recall struggle in its extreme. On the one hand the OEM has a medical compliance obligation to manage the product recall and replacement. On the other hand, the OEM has no visibility on who owns them, because the bulk of the units were sold via the indirect sales channel.

Though the OEM does not have visibility on the end-user of the affected units, the OEM does have a record of the serial numbers sent to the dealers/resellers. Those dealer/ resellers ‘own’ the commercial relationship with the end-user, potentially having sold a service contract too. In this model, the OEM is the orchestrator of the recall, whereas the dealer/resellers are the eyes, ears and hands.

Prioritizing the roll out

Once the OEM has diagnosed the product issue and created an engineering change, the complete supply chain needs restocking. First, the faulty components need to be recalled, to avoid a widening of the quality issue. Then, the new components start to fill the pipeline to enable the roll-out.

Because the production of the new component version needs to ramp up, there is a constrained supply in the early days of the recall, which is a form of service campaign. At the same time, vocal customers will demand instant replacement. Scarcity will require the OEM to make choices and communicate them.

If the OEM only has information on shipping volumes to dealers/resellers, prioritization options are coarse. That becomes more apparent when the dealer/reseller has sold a ‘gold’ contract to the end-user. The end-user has a perception that it purchased an OEM product with an associated gold contract, oblivious to the fact that both elements are delivered by two different commercial and legal entities. That becomes an interesting prioritization puzzle and can become a cause for discontent when not accounted for.

Monitoring the service campaign

Now let’s assume you are in the middle of rolling out the engineering change to your installed base. How do you know you are done? When have you successfully completed the product recall and can you prove that you are compliant?

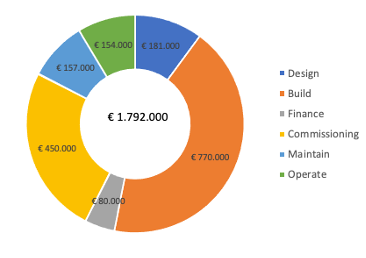

Based on our conversations with OEMs, we’re hearing a need for a workbench-like tool to slice the installed based according to multiple and changing criteria, while maintaining an overview of progress and cost. Last but not least, having tools to prove you’ve done the work and communicate that to the involved stakeholders. At ServiceMax, we’ve bundled these capabilities as Service Campaigns enabling any OEM to be prepared and enabled for future product recalls.

This article is published on Diginomica and Field Service Digital.