In my previous life I sold service contracts for a large OEM. Like many service executives, I was proud of profit margins in the range of 40-60%. But when I talked to my CFO, the numbers didn’t compute in the bigger organisational picture. Let me take you on a narrative of planned versus actual contract profitability and how I gained control over my margin contribution.

Reactive margin contribution

It is still early in the new fiscal year. I have good hopes of making my numbers. Of course I know I have a few ‘high maintenance’ customers. At the same time I have a few ‘cash cow’ service contracts. They will balance out, I’m confident.

Fast forwarding to the last quarter of the year. Am I still that confident? Obviously I have more insights into my year-to-date cost. Did everything pan out as expected? What options do I have in the remaing weeks of the year to make my numbers?

What I am trying to say. No matter how good my predictions and projections were, actual performance has a tendency to differ from planned performance. Maybe less on aggregate level, but certainly on individual customer or contract level.

I want to speak the same language as my CFO to better align with the corporate agenda.

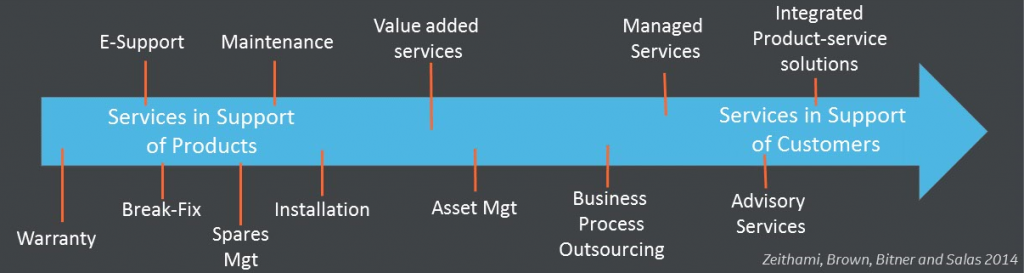

It was my ambition to be more in control. Not to depend on reactive and aggregate margin contribution, but to be proactive and predictive on individual customer/ contract level.

Defining the selling price

When I started selling service contracts I had to brush up my sales 101. How do I define the seling price of my service contracts. I had three paradigms at my disposal.

- Selling price = Cost plus Margin (aka Cost Plus)

- Margin = Selling price minus Cost

- Cost = Selling price minus Margin

If I had full visibility on cost and I had the upper hand in the commercials, then cost plus would work for me. My reality was that cost was more of a guesstimate. Rearding the margin, we had internal margin objectives. But in the commercial arena we often had to give in. This led to the acceptance of the second equation. Margin was not a driver but a result. Margin was reactive.

Expanding on the narrative in the first paragraph: in the last quarter of the fiscal year the CFO would become vocal using the third equation. If the selling price was an unalterable fact and the margins were falling low, then only available option was to cut my cost.

I want to get ahead of the game to deliver predictable margin contribution.

Influence cost while you can

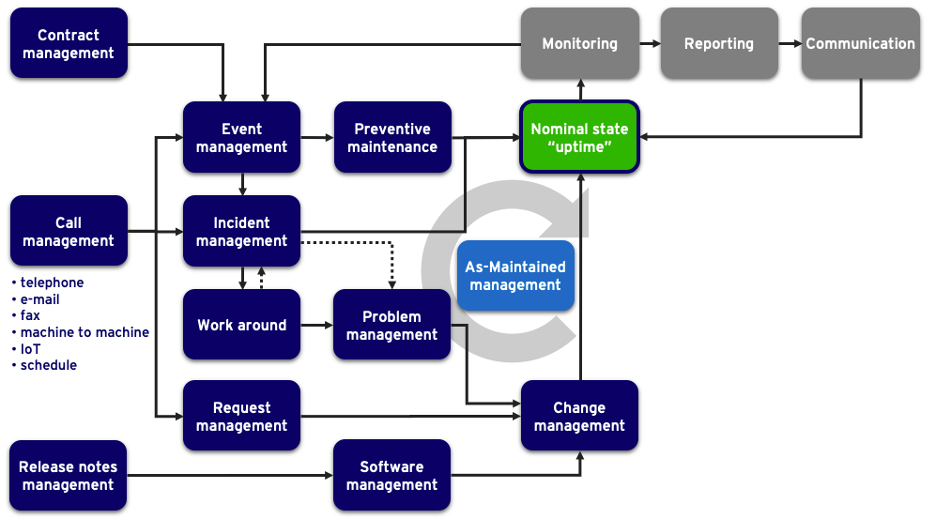

I went back to my drawing board. How shall I construct my service contracts such that I can monitor all three variables: cost, revenue and margin? In addition I implemented the basic financial concept of planned versus actual and outlook in my service execution process.

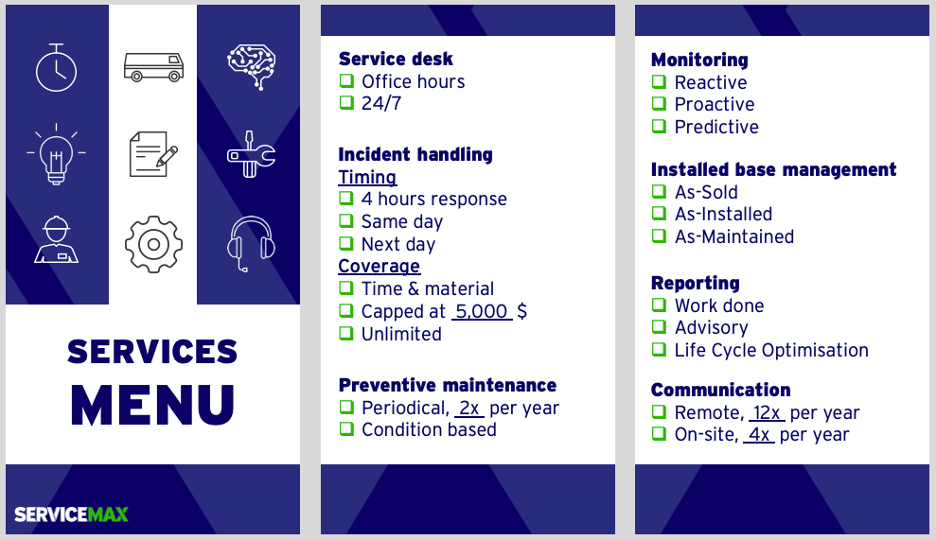

After having had my service menucard conversation with my customer, I would cost all those entitlements, resulting in the sum of planned cost. When the contract went into service-delivery mode I would keep a tally on the actual cost. If actual cost develops in a bandwidth of say 10% or planned cost, I knew I would deliver on the expected margin.

Beyond the actual cost development, modern day service execution tools also provide visibility of future service activies. Thus you can create a cost outlook as well. Now you have all the info to make the right decision in real-time, protecting your margins.

Predictive margin contribution

Why all this fuss? Apart from my personal and service domain motivation, my CFO told me loud and clear: I dislike surprises, I want predictability. If only I could cater to the CFO’s wants, maybe I could get access to budget to mature my processes.

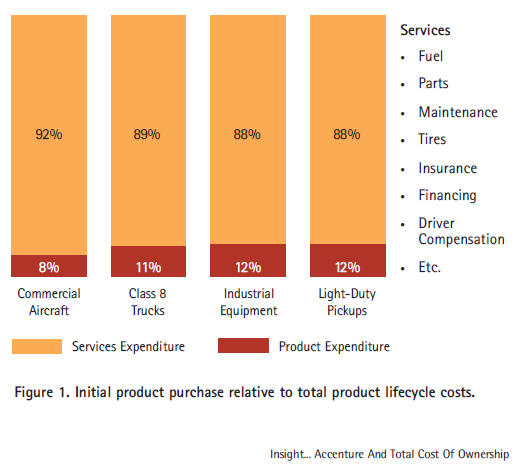

I knew I was probably the single largest margin contributor to my companies result. Maybe more out of luck than by design. If only I could invest in tools that would give me that control and predictability.

Better and competitive pricing

Beyond the CFO persona I want to highlight role and importance of the Service-Sales persona. Setting the selling price for a service contract is a subtle process. Price pressure is prevalent in pretty much every sales cycle. The Service-Sales persona needs handles to balance revenue versus margin contribution.

Asset owners want maximum uptime at lowest operational cost.

When my cost insights were on guesstimate level, cost plus did occasionally result in non-competive price points. When my cost guesstimate was too low, my margin took a hit. When I started monitoring the actual margin, I got a good idea if I had priced my service contract ‘fairly’. Deliberately I’ve put the word fairly between quotes. High margins may be good for my bottom line, but from a customer perspective high margins may not be sustainable. Margin insights were an absolute must have for me when renewing/ renegotiating my service contracts.

This article is published on Diginomica and Field Service Digital.