Last week the European field service community convened for the first time in large numbers at WBR Field Service in Amsterdam. We had a lot of catching up to do. Apart from topics addressing the next big thing, the down-to-earth conversations had a common theme: where are my spare parts? Covid-19, Ever Given, and geo-political instability are disrupting supply chains. As a result, our service engineers are struggling to keep the world running due to missing parts.

We apologize for the inconvenience

My colleague brought her car for regular service. Due to the unavailability of spares, her car was in repair for five weeks. In the meanwhile, she got a rental. Guess what that costs? Guess what it does to brand and customer experience?

My out-of-warranty high-tech desk lamp showed intermittent behavior ten months ago. Customer support told me that due to a shortage of tools and materials they could not help me other than putting me on hold. After many touch points and mounting emotional pressure, they’ve sent me a new lamp for free. Though relieved I finally have light again, I’m not sure about a repeat purchase.

Last week a heavy truck made an illegal u-turn on an important thoroughfare in our city, overturning multiple traffic lights. Due to supply chain disruptions, repair material is due to arrive in three months. Now the intersection is partially blocked and traffic during rush hour has to be managed by traffic officers. Can you imagine the traffic congestion and productivity hours lost?

Supply disruptions are here to stay

For many years we’ve taken smooth and lean supply chain execution for granted. As a result, most field service initiatives were about optimizing the labor component and deploying smart technology. Recent events trigger a wake-up call. Spares availability is back on the agenda.

For a lot of service organizations, spare parts cost is the second largest cost component after labor cost. With increasing and consistent supply chain disruptions, spare parts availability is becoming distractor number one. This is preventing organizations from keeping their installed base up and running. This is causing organizations to default on SLA and contractual obligations.

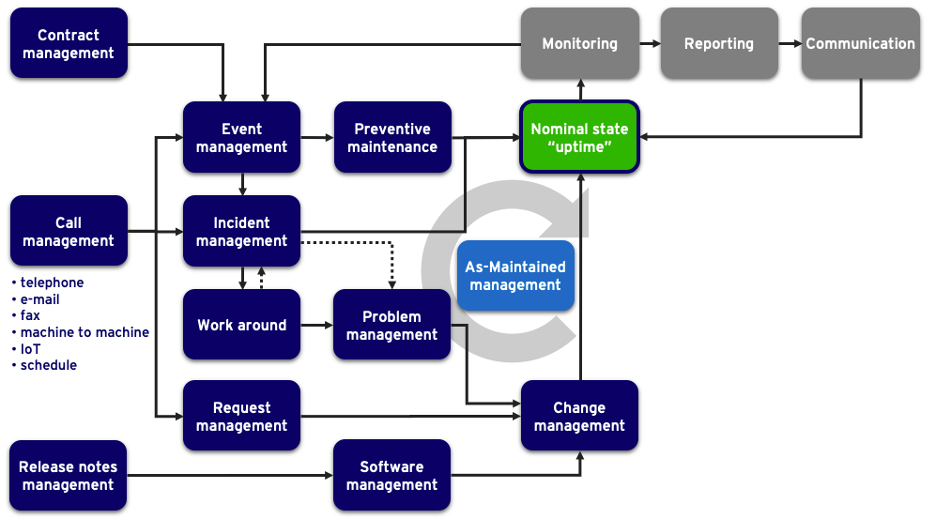

Of all the supply chain-related challenges, the two most discussed topics at WBR Amsterdam were:

- How do we get sufficient parts for our service commitments?

- And, in case we have a shortage, how do we prioritize parts availability?

Alternative sourcing

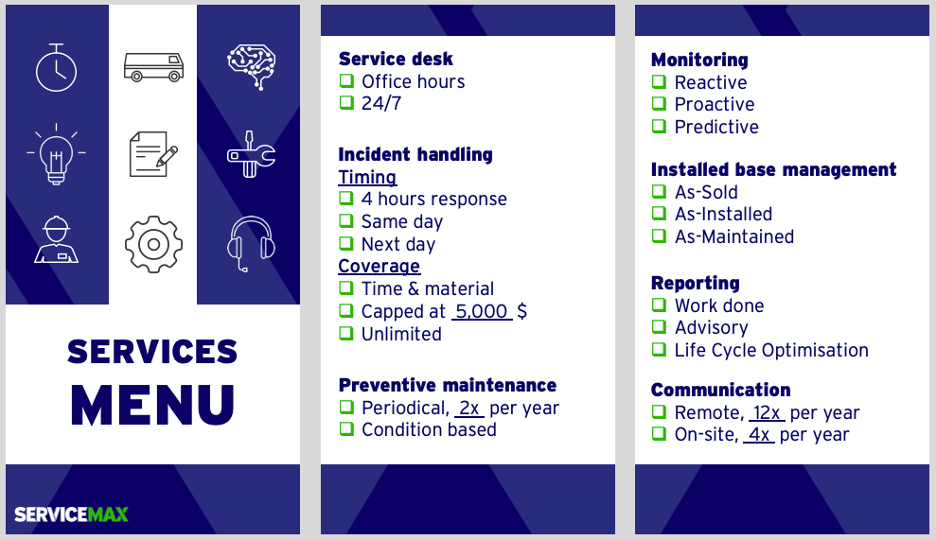

Everything that comes out of an asset after a service intervention represents a residual value. That value increases when your normal parts supply gets disrupted.

In my career, I’ve experienced that those reverse materials tend to disappear in a ‘grey circuit’ when not facilitating my technicians with an easy and guided admin for proper reverse routing and handling.

What I formerly saw as a hassle to manage, now becomes a welcome additional source of supply. Apart from solving the sheer availability of parts, the lower cost of refurbished parts allows me to offer differentiated pricing when using parts. I can now choose from new, equal-to-new, certified-spare-part, and used-class. This provides me with both a commercial advantage as well as a cost reduction. I win on multiple axes.

Spread the wealth

Even with an additional source of supply through reverse channels, I still had situations where the demand for parts was larger than the supply. My challenge is how do I spread the wealth of available material over all my demanding customers?

My most extreme situation where supply and demand were out of sync, was when I faced a quality-related recall. Overnight, all existing asset owners would demand a retrofit while my supply chain was restocking on the new revision level. I felt a need to prioritize both internal business objectives and customer entitlements.

Typical supply chain solutions allowed me to deploy first-come-first-serve. Advanced service execution systems enabled me to prioritize based on Account and Service Contract attributes. For example, platinum customers first, or contracts up for renewal in the next 6 months first. Contingent to my business objectives I could spread the wealth and manage the risks of scarcity.

Inconvenience alleviated

Supply chain disruptions and mismatches between supply and demand for spares will continue to cause inconveniences. With modern-day tools, we can alleviate the pain and remove the arbitrariness of scarcity.

It’s a bit like waiting in the queue at a call center. We don’t like waiting, but at least we have visibility on the queue. And if that is too long, we can upgrade our service level to get the benefits of a priority queue.

Learn about ServiceMax’s solutions for spare parts, returns and depot repair management:

Continue reading about spare parts planning and supply chain disruption:

- Optimizing Parts Availability While Controlling Inventory Costs

- 5 Ways to Navigate Supply Chain Challenges

This article is published on Field Service Digital.