On the Maximize agenda we offered set of 12 round tables spanning a range from covid implications to asset centric business models. From technician skill profiles to commercial maturity. These topics fuelled a wide range of conversations. In this blog we’ll try to give you a taste. Want more? Have a look at the Maximize recordings here: https://www.servicemax.com/maximize/

From short trial to longer-term innovation: lessons/ practices from COVID that will persist

A little over a year ago we learnt about Covid-19. Denial, anger, bargaining, depression and acceptance. We’ve been through it all. Covid-19 drove a number of changes in the way service was delivered and consumed. Organisations quickly deployed new solutions and digital technologies to enable their workers to continue to deliver service to their customers.

In this round table the participants shared what changes are merely short-term adjustments or disruptions to the normal and which ones are longer-term innovations that are here to stay.

No surprise employee safety, compliance and remote service are high on the list of the more permanent changes. The underlying business issues were there all along, only Covid-19 amplified and accelerated the change.

What Covid-19 has also shown us, disruption has many forms. So better prepare to be agile and resilient. As a final thought: how is your organisation going to handle the backlog of push-out work orders? How are you going to prioritise while meeting your contractual obligations?

Recommended Maximize sessions:

- Keynote: Making your Service Business Resilient with ServiceMax

- Business Transformation: Listen to Your Assets: The Benefits of Using Asset Data for Business Outcomes

Recommended readings:

- Transforming Field Service When the “Field” Has Changed (March 11th, 2021)

- The Year Ahead for Energy: 3 Paths to Success Post-Covid-19 (March 9th, 2021)

- 8 Considerations for Your Remote Support Program (February 4th, 2021)

- How Will AR & VR Impact the Future of Field Service Management? (December 22nd, 2021)

The technician profile: changing role, changing skillsets – where do we find them?

Assets are changing. Service work is changing. The nature of customer relationships is changing. Has the technician skillset changed to match the evolution of service taking place?

We ask a lot of our technicians. We ask them to be our brand ambassador. They want to be a hero on site. Maybe then best ‘gift’ we can give technicians is empowerment. To give them tools allowing them to engage with the right information at their fingertips. With a right balance between autonomy for the technician and control for the manager.

Is that possible? Sure. The discussion showed plenty of examples of how the combination of state-of-the-art service execution tools and empowerment drives adoption … and thus the projected business results. Once people see transformation in action, the mindset will follow leading to an intrinsic motivation.

Recommended Maximize sessions:

- Keynote: Building Resilient Relationships. Being a Technician during the Pandemic

- MaxTalk: Save my Bacon – Remote Assistant in the Field

Recommended readings:

- 2021 Predictions for Chief Service Officers (December 15th, 2020)

- Technician Advice to CSOs: 3 Interesting Takeaways from Our Inaugural Tech Talk Event (August 25th, 2020)

Enhancing the commercial maturity of your services business

Now most service organisations have a revenue target, we found it interesting to have a conversation on commercial maturity. You seemed to agree. We had a great turn out at our round table and engaging conversations.

Why is commercial maturity so important? Because margin contribution stemming from operational excellence is not enough. Organisations feel the pressure of margin erosion and commoditisation. In parallel there is a constant drive for growth. And with more vocal customers it is adamant to constantly ride the waves commerce.

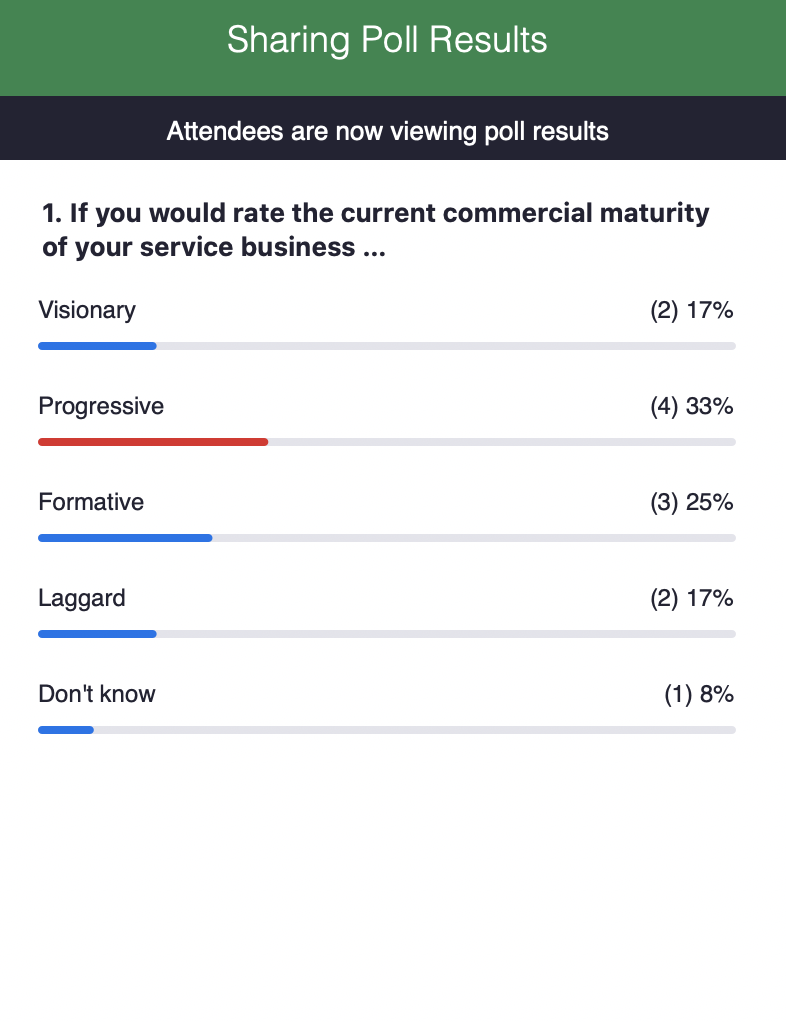

We asked the participants to self-assess their current maturity using a poll. Defining a low maturity as a predominantly product focussed organisation selling services as an afterthought. On the other end of the scale, we positioned companies where both sales and service revenue generating activities are managed in unison over the life cycle of the product/ equipment/ asset.

To make the maturity assessment tangible and actionable we’d given the participants a simple calculation exercise. Suppose you have an installed base visibility of 100% and an attach rate of 100% ‘gold’ contracts. Meaning all installed products have an associated all-inclusive service tier. How much revenue would that amount to? Do we have your attention?

Now compare this figure with your current services revenue. The goal of this exercise is to define the ‘gap’ and to use the gap as an instrument to drive your commercial maturity journey.

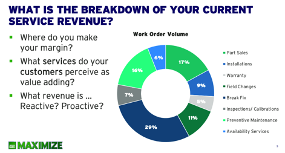

Of course, we know that not all asset owners will buy the gold tier. More likely we have a mix of warranty, part sales, installations, break-fix, field change requests, inspections/ calibrations, preventive maintenance and availability services. Each of these services has a different revenue and margin contribution. If you want to maximize your revenue, you’ll have to revisit your current services portfolio and how you present these offerings.

Recommended Maximize sessions:

- Asset360: How to Unlock New Revenue Streams with Warranty and Contract management

- Business Transformation: How to Protect and Increase Your Service Revenue Stream with an Eye on Servitization

- Business Transformation: How to Revitalize Your Service Portfolio for CEx and Growth

Recommended readings:

- The key to Sales and Service working in collaboration (January 26th, 2021)

- 5 Ways to identify new revenue streams in Service (November 24th, 2020)

- Upsell leakage: Everything you need to know (November 19th, 2020)

- How to sell Customers on the value of preventive maintenance (July 9th, 2020)

The installed base’s role in lifecycle management

Peter Drucker said: “if you can’t measure it, you can’t manage it”. We could say the same thing about the installed base. If you don’t know where your product is, in what condition and how it is being used, how can you excel in service? How can you serve asset owners over the lifecycle of the product?

A survey by Accenture stipulated that over the lifecycle of industrial assets approximately 8-12% of the cost is related to the purchase of the equipment. The rest is maintenance and operating cost. These numbers should convince any OEM to step up to the plate and offer life cycle services.

What do you do when you sell a significant number of units via the indirect sales channel, via dealers and resellers? Value chain actors that may shield their installed base data. The engineering change request may come to rescue. As OEM you have a legitimate reason to reach out to the asset owners, whether it is quality related or if the change enhances the capabilities of your product.

Recommended Maximize sessions:

- Asset360: How to Unlock New Revenue Streams with Warranty and Contract management

- Business Transformation: How to Revitalize Your Service Portfolio for CEx and Growth

Recommended readings:

- 3 Steps to make engineering change management easier (March 2nd, 2021)

- How to maintain and protect your brand as an OEM (December 17th, 2020)

- Looking for Design-for-Service? Start here (December 10th, 2020)

- How to sell Customers on the value of preventive maintenance (July 9th, 2020)

This article is published in ServiceMax Field Service Digital on April 15th, 2021