Each time when you launch an engineering change (EC) campaign you’ll have to balance brand image, quality and cost. In my previous blog 3 Steps to Make Engineering Change Management Easier (FSD, March 2nd, 2021), I added two additional business drivers: customer engagement and upsell revenue. I promised to elaborate on EC strategies, on how to use the EC touch points to further your business objectives.

But first I want to say thanks to a reader who helped me frame the two different emotions associated with an engineering change: the ‘positive’ and the ‘negative’ engineering change.

- Negative: the EC is triggered by a quality issue or a complaint.

- Positive: the EC improves the specifications/ capabilities of the original product.

Does the emotion matter? Yes, it does and maybe it shouldn’t matter that much. Let me explain.

When the negative emotion is associated with cost and a perceived reduction of CX & brand value, its mitigation is deemed operational. Getting your act together. When using the EC as an instrument to exceed expectations, the positive emotion will trigger growth driven stakeholders to jump on the bandwagon. With a comprehensive EC strategy, you can nudge the negative to the positive side too.

“There’s no such thing as bad publicity” – P.T. Barnum (1810 – 1891)

Creating a plan

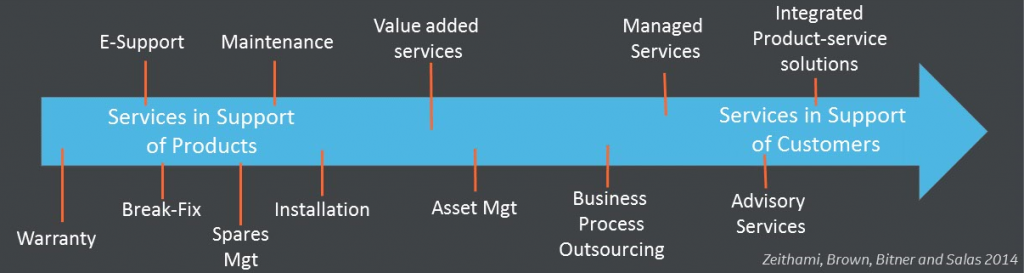

Creating an engineering change strategy is a subset of product life cycle management. During the operational life cycle of a product many things can happen. Some of these occurrences are pre-conceived and/or planned. Some will happen ‘as you go’. Simply because it is nearly impossible to predict how a product will behave in each and individual use context.

Creating a plan is like preparing for the unknown. The good news is that the unknown can be moulded into a limited number of buckets:

- The product does not deliver on its as-sold and nominal attributes

- The product is used in a context beyond its nominal attributes

- New product capabilities enhance the nominal specifications

For each of the three buckets you can create a communication channel with your installed base and define a follow-up workflow. As a potential response to each of the three buckets:

- Document and investigate the gap, provide a product fix … or change the expectation.

- Investigate the use context of the product and re-evaluate the product specifications. Advise on product replacement or product upgrade possibilities.

- Filter the installed base on those customers that will perceive the enhanced specifications as a value add.

Each of these workflows impacts cost, revenue and CSAT. Most of all, you build a communication relationship with your installed base, managing customer experience over the life cycle … and beyond. Just imagine your EC strategy becoming the proactive/ predictive instrument to avoid unplanned downtime.

What does your customer buy and expect?

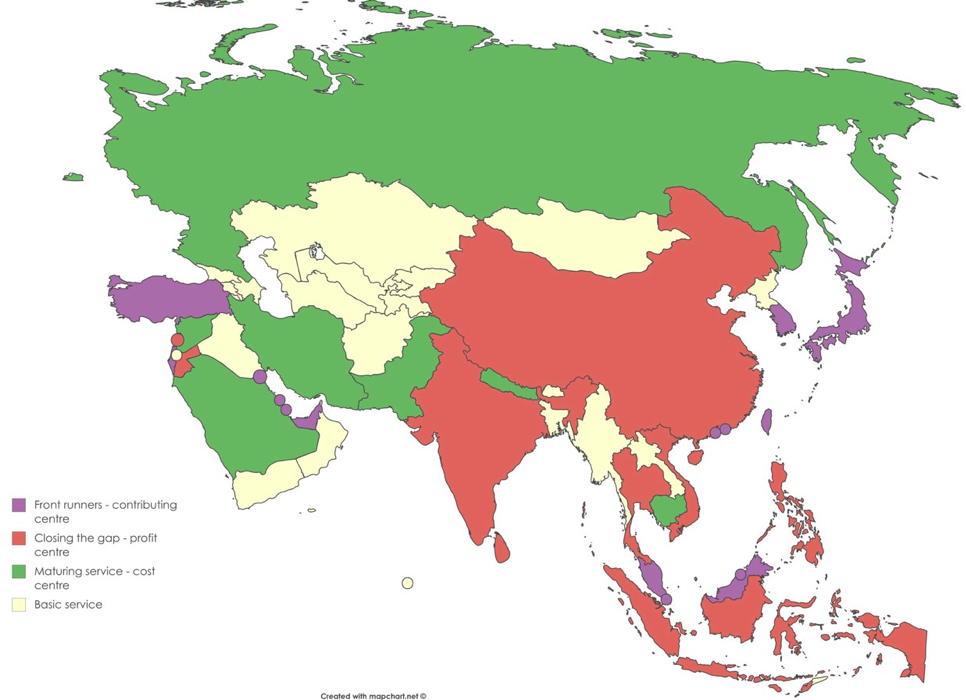

Words like strategy and lifecycle imply a longer timeframe. This requires us to revisit the original value promise made at point of sale. Is that promise a one-off or a longer-term commitment? The answer will impact your EC strategy.

If the sales value promise is a one-off, the customer buys the product as-is with an optional limited warranty. Because warranty is an integral part of the product sale, we need to define both coverage and period. Also, we must be mindful of expectations and regulations.

- In Japan the phrase “Quality is included” drives EC and lifecycle services to high expectations with ample opportunities to monetise them.

- In Germany the warranty construct is decomposed in two definitions “Gewährleistung” and “Garantie”. The former relates to a defect and/or violation of regulations, the latter is a voluntary value promise.

- When you buy a product from a AAA-brand you’ll likely have a different lifecycle support expectation over a B-brand.

With the above components it becomes clear that you’ll need a product lifecycle vision with an EC strategy spinoff.

A steady flow of engineering changes waiting for a framework

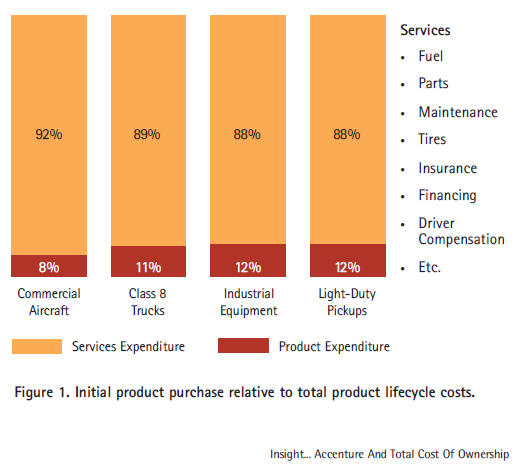

Now, let’s expand the horizon beyond the warranty period. Your customer may have bought a product. What your customer needs is the output and outcome of that product, preferably over a longer period of time. Over that time entropy and technology advancement are the biggest drivers for engineering changes.

Knowing you’ll have a steady flow of ECs you’ll need a framework to manage them. Even more so when we’ve learnt in the previous blog that ECs often occur in an environment of constraints. You’ll need to make choices of who gets scarcity first, knowing this will impact cost, revenue and CSAT.

Scarcity is a multi-facetted ‘beast’. It can work both for and against you. Thus, one more reason to put a lot of thought into defining an EC strategy.

“There is only one thing in the world worse than being talked about, and that is not being talked about.” – Oscar Wilde

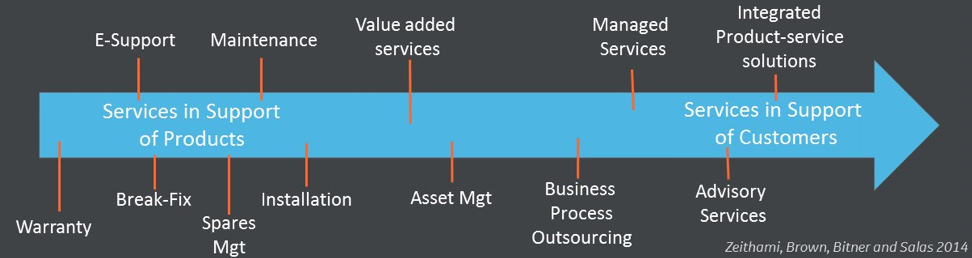

Every touch point is an opportunity

In the world of sales and engagement the mantra is: every touch point is an opportunity. Throughout the operational life cycle of a product there are many touch points. When you can explain entropy and technology advancement in its use context, when you have a compelling engineering change strategy and when you can embed that EC strategy in your service portfolio, then you’ll get the level of engagement and life cycle partnership you seek. Driving cost, revenue and CSAT to both party’s satisfaction.

This article is published in ServiceMax Field Service Digital on May 4th, 2021